Equiano Rum - What Happened?

Recently (early September 2025) Ian Burrell shared widely on social media that he would no longer be representing Equiano, a rum brand he was a director of and co-founded. His post included the following passage:

While I am a founder and shareholder of EQUIANO LIMITED, it has come to light that the corresponding trademark was NEVER registered in the company’s name but was purportedly registered by a company controlled by another of our founding director & shareholder.

Therefore, I can no longer continue to represent the Equiano Rum brand and I have retained counsel in the matter.

Equiano is very well-known in rum enthusiast circles, and I’m sure like many others, I was surprised by this and wanted to know more. Having previously used trademark databases for stories like Plantation Rum Becomes Planteray Rum, I learned that Equiano was trademarked in 2020 by Crave Communications, which is owned by Aaisa Dadral, another of Equiano’s co-founders and directors.

During my research, I found significantly more information in the public record regarding the operations of Equiano Limited, the brand’s owner. Almost every new spirit brand faces challenges on many fronts in its early years, and Equiano was no exception. What follows is instructive to those pondering launching their own brand or investing in an existing brand.

To summarize, despite its popularity and numerous awards, Equiano Limited may have operated at loss each year since its 2019 inception. In 2025 the company went into “administration.” A June 2025 publicly available filing with the UK government (AM03 Notice of Administrator’s Proposals) notes:

In the absence of additional funding and having reviewed the projected cash flow, the directors resolved to place the Company into Administration on 13 May 2025.

What this means is that the courts, creditors, or directors of the company appointed an external administrator to run the company. The administrator’s role is to run the company while protecting it from legal action by creditors, as well as attempting to rescue it as a going concern. (For U.S. readers, the closest thing to administration is Chapter 11 bankruptcy.)

It’s also worth noting that Equiano launched shortly before the COVID-19 pandemic, creating additional headwinds for the young company.

Equiano’s Early Days

The UK government filing provides a summary of the company’s history. In what follows, I’ll quote key passages that tell the story, starting with:

The Company (initially, Blue Acorn Limited) was incorporated on 6 March 2019. The Company’s initial funding came from the founding shareholders, three of whom hold a majority shareholding and became directors of the Company.

Further investment followed in April 2019, facilitating creation of the product and an initial production run.

A further round of seed funding totalling approximately £900,000 was secured in late 2019 / early 2020. Further funding was secured from several global rum partners, adding credibility to the business. This funding was utilised to produce inventory and launch the business.

From the public incorporation documents, two of the initial directors and largest initial shareholders were:

Ian Burrell

Oliver Bartlam

Funding Rounds

The AM03 filing with the UK government continues:

The Company secured further investment through a strategic lead investor who completed a Series A investment of £1.5m across 2021-2022. They expressed an intention to take all required future investment rounds moving forward and funding was received in sporadic tranches. However, given the Company’s size and that cash outflows at that time were relatively low, the sporadic funding was not detrimental to the business.

Given the amount (£1.5m) and timing, the “lead investor” could be Uncle Nearest Investment Fund, the investment arm of Uncle Nearest whiskey.

Some of you may recall that Uncle Nearest has been in the news recently and is facing a lawsuit after allegedly defaulting on over $100 million in loans.

Financial Challenges.

The AM03 UK government filing continues:

The lead investor subsequently committed a further £2.7m to the business in 2022, taking the full Series B round of investment. Payments again came in sporadically across 2023. By this stage, the Company was operating in multiple countries and appeared to be gaining traction in the market. However, the sporadic nature of continued investment was by now becoming disruptive to operations and growth.

Further investment of approximately £600,000 had been anticipated to arrive in the summer of 2023 but this did not materialise, and the business was thereafter unable to secure further investment .… without additional funds, the business was unable to purchase new stock, grow or support existing markets.

In order to preserve cashflow and protect creditors, in summer 2024 the Company terminated contracts with several sales consultants in the USA and in September 2024 it ceased working with its PR and social media agencies. In November 2024, the Company terminated contracts with the remaining consultants and made two of its three full time members of staff in the UK redundant. At this stage, the Company’s directors began taking advice regarding the Company’s solvency position and its options.

Administration

This brings us to 2025. The AM03 filing with the UK government continues:

The business continued to sell its existing stock in the early months of 2025 in order to repay debts whilst conversations with potential investors continued.

In the absence of additional funding and having reviewed the projected cash flow, the directors resolved to place the Company into Administration on 13 May 2025.

…

The Company’s directors held discussions with a number of potential investors in early 2025 as they sought to secure additional funding that would alleviate their cashflow issues …. discussions with potential investors were unsuccessful and therefore on 28 April 2025, Quantuma was formally engaged to contingency plan for a potential insolvency appointment.

On May 13th, 2025, Quantuma Advisory Limited took control of Equiano Limited, and followed up with several actions, including:

The Joint Administrators have taken steps to market the business and assets of the Company via the issuance of a sale proposal summarising the opportunity to invest in, or acquire, the business.

The proposal was circulated to a list of 231 potentially interested parties related to the food and beverage industry and was advertised on the Quantuma LinkedIn page.

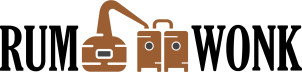

Below is an image from “Project Celeste,” shared in a June 2025 LinkedIn post by Quantuma. While not explicitly mentioning Equiano, the post describes a company remarkably similar to Equiano, stating:

Opportunity to invest in or acquire a multi award-winning* brand of premium rum with a socially conscious ethos. The brand comprises both dark and light rums appealing to a broad range of higher end consumers. The products are 100% natural with no additives, no sugar, and no spices – aimed at the rum connoisseur.

Following a successful launch in late 2019, the business secured its first investment round. Despite the pandemic, the business managed to grow revenues to £746k in 2022, which attracted subsequent investment rounds. Due to recent working capital issues the company is currently in administration.

The business currently has import and distribution partners in 20 plus countries and has established itself in 5 of the largest markets, including UK, Canada, Germany, US and Italy.

The LinkedIn post also includes unaudited financial results for the years 2021 to 2025, each with yearly operating losses between £479K and £1.3M.

Per the AM03 filing, the brand’s five largest shareholders were:

Aaisha Dadral (Director, Brand & Marketing)

Amanda Kakembo (Director, Commercial Director)

Ian Burrell (Director)

Oliver Bartlam (Co-founder and former Director)

Uncle Nearest Investments (Uncle Nearest Whiskey)

The company’s three largest creditors were:

The Rum Experience (Ian Burrell)

Crave Communications (Aaisha Dadral)

Equiano’s primary rum supplier

Regarding the Equiano trademark, the AM03 filing notes:

The Company used the ‘Equiano’ trademark as part of its day-to-day trading. This trademark was initially registered by Crave Communications Limited on 11 September 2019, a company in which one of the Company’s directors and shareholders is the sole director.

It is understood that all intellectual property rights in the registrations, including all associated goodwill, is owned exclusively by Crave Communications Limited.

Discussions are on-going in respect of the use of the intellectual property rights going forward.

Today

As of early September 2025, it’s not publicly known if Equiano Limited and the associated brand have been sold. However, in July 2025, Oliver Bartlam, one of the founders and large shareholder of Equiano, as well as one of Equiano’s former directors, registered a new company in the UK, Equiano Global Limited.

I won’t speculate here about Equiano Limited’s management or the actions of its directors. Everything I’ve included above is either excerpted from UK company filings or other publicly shared information.

Ouch. This isn't going to be pretty. Bridges are burning. Pity a company that (apparently) tried to operate ethically has come apart like this.

well done!